Value of Silver Bullion: It’s Importance For Investors

The value of silver bullion has been an important milestone of wealth security and portfolio diversification for many years. At Universal Gold, we recognize the importance of silver bullion as a stable asset that provides stability during economic fluctuations. Moreover, investors continue to get attracted towards this precious metal as a protection against inflation as well as currency devaluation. With growing interest in the silver bullion, knowing its true value is important for making informed fund investment decisions.

Learning about the Value of Silver Bullion

The value of silver bullion is more than just its market price. It holds a range of factors that add to its demand in the industry. Universal Gold knows that silver bullion has great value. This is due to its industrial uses, historical importance, and increasing demand in both jewelry and investment markets. This stable asset offers investors with an alternative approach to paper currency, which is usually an easy target for inflation.

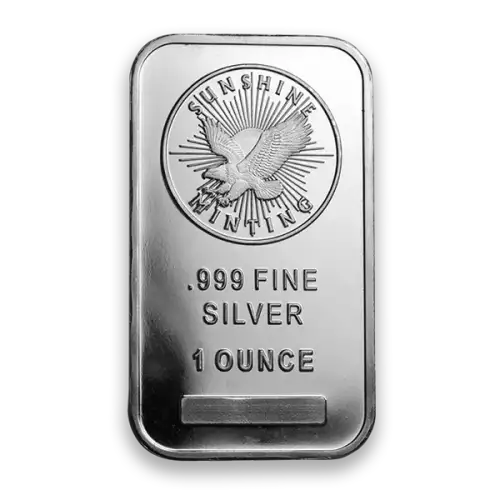

When learning about the value of silver bullion, investors usually take in consideration the product’s purity and weight. Silver coins and silver bars are common forms of the metal that investors purchase to improve their portfolios. Moreover, these physical assets provide a sense of security. As they can be saved and made use of during times of financial instability. Furthermore, the silver price Canada changes are based on the global supply and demand market. Making it important for purchasers to stay up to date with the market trends.

The Growing Demand for Silver Bullion

As the value of silver bullion is constantly rising, more investors are learning about its long term potential and worth. Universal Gold has seen a significant increase in the demand for silver bullion among both experienced and new investors. This rising interest is due to silver’s double role both as an industrial product as well as a store of value.

Silver bullion is greatly used in industries such as electronics, solar power, and medical devices. This industrial demand further increases its value and sets it apart from other precious metals. Additionally, silver coins and silver bars are a popular choice among collectors and buyers wanting to increase their wealth. Moreover, the silver price in Canada usually shows the global economic changes, making silver bullion a strong and valuable asset.

Silver Bullion as a Tool against Inflation

One of the most important reasons that investors are turning to silver bullion is its ability to hedge against the inflation. At Universal Gold we advise our clients to take silver bullion as a way of securing a purchasing power during phases of increasing inflation. Unlike paper currency, whose value decreases over time. Silver bullion keeps its value due to its rareness and industrial demand.

Furthermore, silver coins and silver bars serve as a stable store of wealth. Offering security in fluctuating economic situations. Keeping in check the silver price in Canada will help purchasers identify helpful times to buy silver bullion and improve their portfolios. As the pressure of inflation continues to grow, the value of silver bullion stays as a reliable safeguard against financial uncertainty.

The Role of Silver Price in Canada

Investors often choose between silver coins and silver bars when adding silver bullion to their portfolios. Universal Gold provides a suitable selection of both the options to meet the different needs and investment visions. Silver coins are preferred for their unique designs and historical importance, making them highly attractive for collectors. Alternatively, silver bars are known for their simple and lower premiums over the spot price of silver bullion. Regardless of the form selected, both silver coins and silver bars offer investors with stable assets that have long term value. Having an eye on the silver price in Canada will allow buyers to make proper decisions when buying silver bullion.

The silver price in Canada plays an important role in deciding the value of silver bullion. Moreover, factors such as the global supply and demand, geo political problems, and currency movements greatly affect the silver price in Canada. Investors closely check the industry trends to grab opportunities and increase the returns. The silver price in Canada acts as a bench mark, guiding buyers in their need of silver coins, silver bars, and other forms of silver bullion. Staying updated with these price changes will help purchasers make their way in the market with confidence.

Conclusion

Universal Gold is fully committed to helping investors through the process of getting silver bullion. Therefore, whether you are looking for silver coins, silver bars, or update about the silver price in Canada. We are offering expert and reliable products that you can count on. Moreover, the value of silver bullion goes beyond just the short term gains. It portrays a long lasting investment that can stand the phases of extreme economic uncertainty. With the support of Universal Gold, buyers can gain the potential of silver bullion and build a strong financial future.