Price of Silver Canada Per Ounce: How to Get the Best Deal?

The price of silver Canada per ounce fluctuates daily based on market demand, economic conditions, and global trends. Whether you’re an investor or a collector, getting the best deal requires understanding market rates, comparing reputable dealers, and considering factors like premiums and spot prices. Researching online platforms, local bullion shops, and financial institutions can help secure competitive pricing. This guide explores key strategies to ensure you make informed decisions when buying silver in Canada at the best possible price.

Reasons Of Fluctuations In Price of Silver Canada Per Ounce

Different reasons cause the price of silver Canada per ounce to fluctuate. Three major reasons are inflation, economic uncertainty and global market demand. Investor sentiment, mining production, and changes in the US dollar value also play key roles. Interest rates, geopolitical events and supply chain disruptions greatly impact silver volatility. Furthermore, industrial usage and government policies can also affect pricing. Silver is both an investment and a commodity. Sudden market speculations can also contribute to frequent shifts in price of silver Canada per ounce.

Major Reasons To Invest In Silver Bullion Metal Asset

Hedge Against Inflation

Silver bullion is an excellent asset that acts as a hedge against inflation. It preserves the purchasing power when there is a decline in fiat currencies. During inflation events, the price of silver eventually increases. This makes it a valuable asset for financial security and long-term wealth preservation.

Affordable Precious Metal Investment

Compared to gold assets, silver bullion is more cost-effective. It allows investors to enter the precious metals market even with lower capital. Silver bullion is a powerful option for beginners and professional investors to diversify the portfolios.

High Industrial Demand

Silver plays a major role in different industries, such as solar panels, electronics, and medical applications. It’s a strategic investment for those seeking to benefit from forthcoming technological advancements.

Tangible Asset with No Counterparty Risk

Unlike bonds or stocks, silver bullion acts hold a powerful store of value. It does not rely on third parties or financial institutions. This reduces any risk of loss or default due to market crashes, banking failures or downturns.

Portfolio Diversification and Wealth Protection

This metal asset adds great diversification to an investment portfolio, reducing any risk of balancing volatile assets. It also serves as a safe-haven investment during economic instability. This protects your price of silver Canada per ounce against currency fluctuations or market downturns.

Is Silver in Canada Taxed?

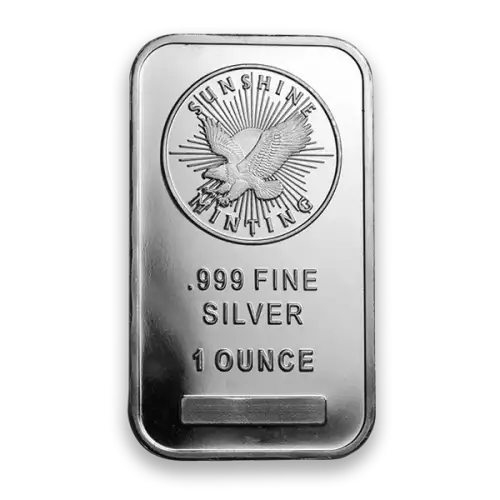

In Canada, most silver bullion products have a purity of .999 or higher. But they are usually exempt from sales tax. Nevertheless, lower-purity silver, numismatic items and collectable silver coins are subject to Provincial Sales Tax (PST) or Goods and Services Tax (GST). Before purchasing any silver asset, investigate the tax status. Tax regulations can vary by province. Always buy from reliable dealers to ensure proper compliance with Canadian tax laws.

Best Time to Buy Silver in Canada for Investors

Understanding the best time to buy silver in Canada helps the investor to maximize profit gains. Few events that hold great value are when inflation rises, during economic uncertainty or when market price dips. Fluctuations in silver price Canada can occur due to geopolitical events, currency strength or supply-demand factors.

Investigating market indicators and tracking historical trends can help investors to make informed decisions. For better buying opportunities, purchase silver when investor sentiment is low or during off-peak seasons. Long-term investors prefer to use dollar-cost averaging to reduce risks of market volatility.

Ensuring The Authenticity of Silver Before Investing

To ensure your silver is authentic, start with a magnet test. Always remember that real silver is non-magnetic. If it gets stuck, this means it is fake. Weigh the silver and compare it with standard weight specifications. Performing a sound test can also help. After tapping a sound, pure silver produces a high-pitched ringing sound. Looking for proper stamps and hallmarks indicating .999 or .9999 purity. Always purchase from reliable dealers providing authentication certificates. Investing in certified silver ensures authenticity, quality and peace of mind.

Unlocking Common Risks of Investing In Silver

No doubt, silver is a valuable investment, but at the same time, it comes with certain drawbacks. Price of silver Canada per ounce can fluctuate due to economic uncertainty, market speculations or geopolitical events. Silver never generates income, unlike bonds or stocks, limiting its growth potential. Furthermore, insurance costs and storage for physical silver can also add up over time. Silver can also face supply and demand fluctuations, causing short-term price swings. Stay cautious about fake silver assets and purchase them from reliable vendors to avoid losses.

FAQs

1. How do you negotiate silver prices with dealers in Canada?

Some local dealers might go for negotiations, especially in bulk purchases. Online dealers have fixed prices, but discounts come with large orders.

2. Is it risky to invest in silver?

Investing in silver can be volatile, but it will affect short-term gains. Some common risks that can appear are market fluctuations, insurance and storage.

3. How do I avoid fake/scam silver in Canada?

Always check for proper mint markings and buy from reputable dealers to avoid fake silver metals. You can also check authenticity through methods like electronic testers or acid tests.

4. What is the advantage of buying silver in large or small quantities?

Buying in bulk often reduces premiums, but smaller pieces provide more flexibility for resale. Your decision should align with investment goals and liquidity needs.

5. How do I store my silver safely?

To protect silver from any damage or theft, secure it in bank safe deposits or use professional storage services for extra security.

Buy Silver Bars from Universal Gold – Pure, Secure, and Reliable!

Looking forward to buy silver bars with .999+ purity? Invest in silver bars by visiting Universal Gold to secure wealth and diversify your portfolio. With trusted sourcing and competitive pricing, we make your investment journey secure and simple. Shop now and make your financial future stronger.